The investment incentives program, which will be effective from the 1st January 2012

comprises 4 different schemes:

1- General Investment Incentive Scheme

2- Regional Investment Incentive Scheme

3- Priority Investment Incentive Scheme

4- Strategic Investment Incentive Scheme

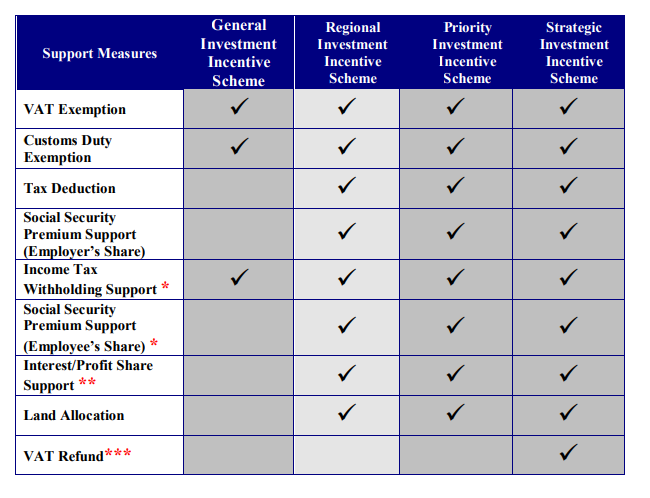

The support measures to be provided within the frame of those schemes are summarized in the table below:

THE SUPPORT MEASURES

VAT Exemption:

In accordance with the measure, VAT is not paid for imported and/or locally provided

investment machinery and equipment as well as selling and renting of intangible rights and

software within the scope of the investment encouragement certificate.

Customs Duty Exemption:

Customs duty is not paid for the machinery and equipment provided from abroad (imported)

within the scope of the investment incentive certificate.

Tax Deduction:

Calculation of income or corporate tax with reduced rates until the total value reaches to the

amount of contribution to the investment according to envisaged rate of contribution.

Social Security Premium Support (Employer’s Share):

The measure stipulates that for the additional employment created by the investment,

employer’s share of social security premium on portions of labor wages corresponding to

amount of legal minimum wage, will be covered by the Ministry.

Income Tax Withholding Allowance:

The measure stipulates that the income tax regarding the additional employment generated by

the investment within the scope of the investment encouragement certificate will not be liable

to withholding. The measure is applicable only for the investments to be made in Region 6

and the strategic investments supported under the TFIMP within the scope of an investment

incentive certificate.

Social Security Premium Support (Employee’s Share):

The measure stipulates that for the additional employment created by the investment,

employee’s share of social security premium on portions of labor wages corresponding to

amount of legal minimum wage, will be covered by the Ministry. The measure is applicable

only for the investments to be made in Region 6 and the strategic investments supported under

the TFIMP within the scope of an investment incentive certificate.

Interest/Profit Share Support:

Interest/Profit share support, is a financial support instrument, provided for the loans with a

term of at least one year obtained within the frame of the investment encouragement

certificate. The measure stipulates that a certain portion of the interest/profit share regarding

the loan equivalent of at most 70% of the fixed investment amount registered in the certificate

will be covered by the Ministry.

Land Allocation:

Refers to allocation of land to the investments with Investment Incentive Certificates, if any in

that province in accordance with the rules and principles determined by the Ministry of

Finance.

VAT Refund:

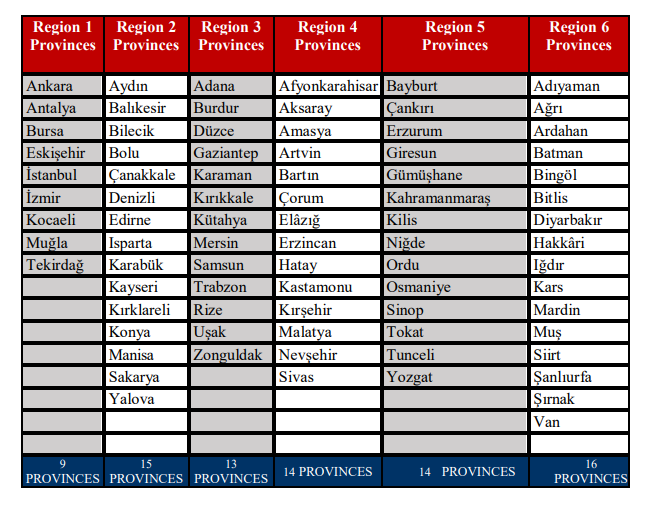

VAT collected on the building & construction expenses made within the frame of strategic investments with a fixed investment amount of 500 million TL will be rebated. Effective from 1 January 2021 ,the following Regional Map and Table of Provinces show classification of provinces for the implementation purpose of the Investment Incentives Program

GENERAL INVESTMENT INCENTIVES SCHEME

Regardless of in which Region an investment is made all projects which meet conditions of

specific capacity and the following minimum fixed investment amount will be supported

within the frame of the General Investment Incentives Scheme. Investment subjects which are

excluded from the investment incentives program can not benefit from this scheme.

The amount of minimum fixed investment is 1 million TL in Region 1 and 2 and 500

thousand TL in Regions 3, 4, 5 and 6.

REGIONAL INVESTMENT INCENTIVES SCHEME

The sectors to be supported in each province are determined in accordance with potentials of

the provinces and the economies of scale and the intensity of the supports are differentiated in

line with the development level of the regions.

The amount of minimum fixed investment is defined separately for each sector and each

region, the lowest amount being 1 million TL in Regions 1 and 2, and 500 thousand TL in the

remaining Regions.

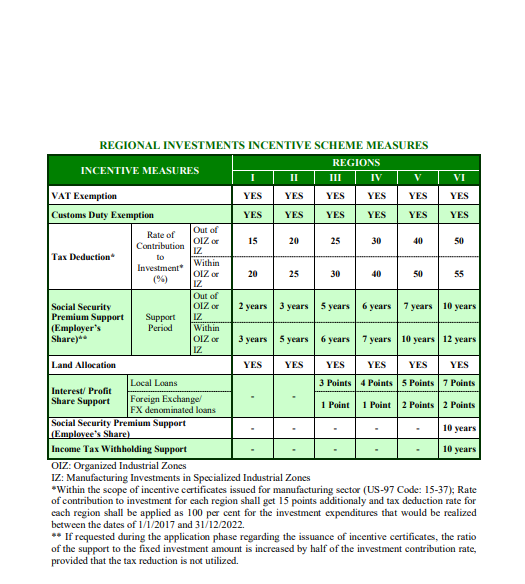

The terms and rates of supports within the Regional Investment Incentives Scheme are

summarized in the Table below:

REGIONAL INVESTMENTS INCENTIVE SCHEME MEASURES

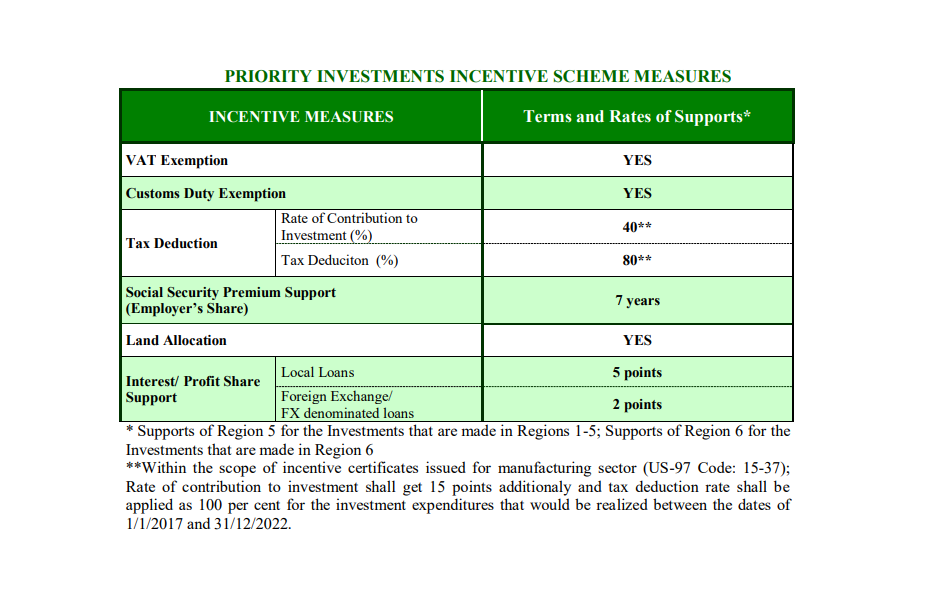

PRIORITY INVESTMENTS INCENTIVE SCHEME

The following investment subjects have been designated as priority investments within the

framework of our country’s requirements and these investments are supported by measures of

Region 5 even if they are made in Regions 1, 2, 3 and 4.

✓ Tourism investments in Cultural and Touristic Preservation and Development Regions

and thermal tourism investments,

✓ Mining investments,

✓ Railroad, maritime and airline transportation investments,

✓ Defense industry investments,

✓ Test center investments for products in the medium-high and high-tech industry class

according to the technology density definition of the Organization for Economic

Cooperation and Development (OECD).Nursery, Preschool, Primary, Middle and High

School and education investments for the use, repair and maintenance of air vehicles

✓ Investments made to manufacture the products and parts designed and developed as an

outcome of the R&D Projects supported by the Ministry of Science, Industry and

Technology, TUBITAK and KOSGEB,

✓ Motorized land vehicles key industry investments with a minimum investment amount

of 300 million TL, automotive engine manufacturing investments with a minimum

amount of 75 million TL and transmission components/parts and automotive electronics

manufacturing investments,

✓ Investments made to generate electricity from coal,

✓ Investments made to generate electricity through waste heat recovery in a facility,

✓ Energy efficiency investments made in existing manufacturing facilities,

✓ Liquefied natural gas (LNG) investments and underground gas storage investments

with a minimum amount of 50 million TL,

✓ Investments of carbon fiber or the composite materials made from carbon fiber

provided that along with carbon fiber production.

✓ Investments made to manufacture high-technology products classified according to

OECD technology intensive definition.

✓ Investments made to explore mines in the permitted fields for the investors holding

Mining License and Certificate.

✓ Investments made to manufacture turbines and generators for renewable energy and

wind turbine wings for wind power.

✓ Integrated investments for aluminium flat products using direct chill slab casting and

hot rolling methods.

✓ Licensed warehousing investments.

✓ Nuclear power plant investments.

✓ Qualified laboratory investmentsGreenhouse investments based on automation with a minimum of 5 million TL, 25 decares and domestic spare parts

✓ Investments subject to Environmental License within the scope of Environmental

Permit and License Regulation. Elderly and Disabled care centers and wellness

investments

✓ Medium-high technology investments amounting to a minimum 500 million TL

✓ Investments in the production of software and information products to be made in

specialized free zones without requiring a minimum investment amount.

✓ R&D and environmental investments

✓ Manufacturing electric or hydrogen-powered transportation vehicles

✓ Qualified laboratory investments REPUBLIC OF TURKEY MINISTRY OF INDUSTRY AND TECHNOLOGY 6

✓ Greenhouse investments based on automation with a minimum of 5 million TL, 25 decares and domestic spare parts

✓ Investments subject to Environmental License within the scope of Environmental Permit and License Regulation. Elderly and Disabled care centers and wellness investments

✓ Medium-high technology investments amounting to a minimum 500 million TL

✓ Investments in the production of software and information products to be made in specialized free zones without requiring a minimum investment amount.

✓ R&D and environmental investments

✓ Manufacturing electric or hydrogen-powered transportation vehicles PRIORITY INVESTMENTS INCENTIVE SCHEME MEASURE

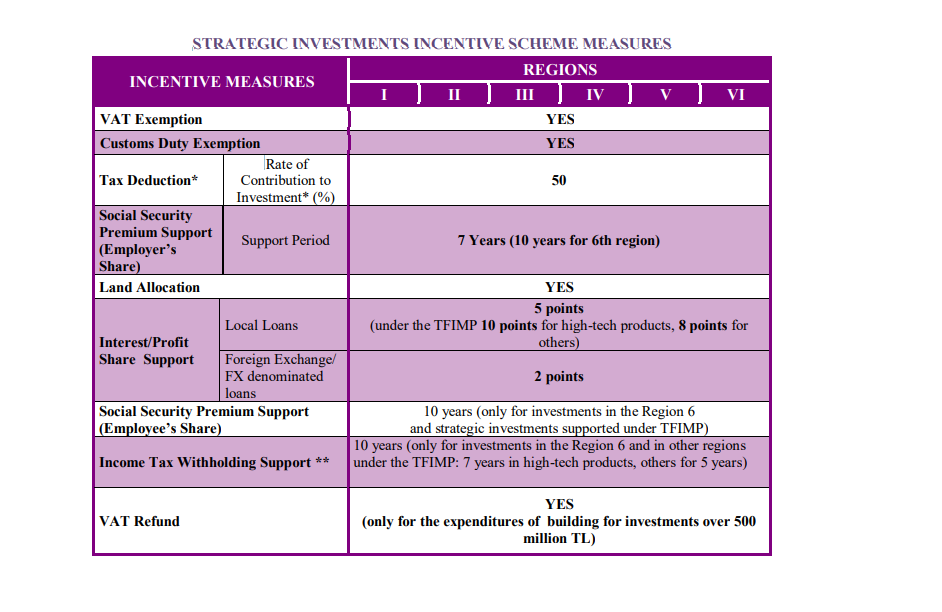

STRATEGIC INVESTMENT INCENTIVE SCHEME

The Goals:

✓ On the basis of the “Input Supply Strategy”, this scheme aims at supporting

production of intermediate and final products with high import dependence with a view to

reduce current account deficit.

✓ It also targets encouraging high-tech and high value added investments with a

potential of strengthening Turkey’s international competitiveness.

Investments meeting the criteria below are supported within the frame of the Strategic

Investment Incentive Scheme:

✓ to be made for production of intermediate and final goods with high import

dependence of which more than 50% of these goods are supplied by imports,

✓ to have a minimum investment amount of 50 million TL,

✓ to create minimum 40% value added (This condition is not applicable to refined

petroleum production investments and petrochemicals production investments),

✓ to have an import amount of at least $50 million for goods to be produced in the last

one-year period (This condition is not applicable to goods with no domestic

production)

The investments approved by the Ministry within the Technology Focused Industry

Movement Program (TFIMP) also be supported within the context of strategic

investments.

SUB-REGIONAL INCENTIVES

Following investments will benefit from more beneficial sub-regional rates and terms for Tax

Deduction and support to employer’s share of social security premium in any region:

• Investments in Organized Industrial Zones and Manufacturing Investments in

Specialized Industrial Zones,

• Joint Investments by multiple (at least 5) companies operating in the same sector which

establish integration to their activities.

• Selected medium-high-technology industries will benefit from terms and rates of the

support measures of Region 4 even if they are made in Regions 1 (except Istanbul), 2, 3.

However, in the organized industrial zones or industrial zones in Istanbul Province, the

regional supports in the 1st region are applied to the investments amounting to a

minimum of 5 million TL, excluding completely new investments.

• Investments to be made in the districts of the provinces of the 1st, 2nd, 3rd and 4th

regions included in Annex-7 of the Decision;

✓ From the regional supports provided to the sub-region of the province where the

district is located;

✓ Investments to be made in the OIZ / EZ of these districts benefit from the regional

supports provided to the two sub-regions of the province where they are located.

• 5 th region provinces;

✓ Regional supports provided to the 6th region for the investments to be made in the

districts included in ANNEX-7,

✓ For the investments to be made in the OIZ / EZ of these districts, Social Security

Premium Support (Employee’s Share), is applied by adding two years to the period

valid in the 6

th region; tax deduction support is applied by adding five points to the

investment contribution rate valid in 6

th region.

• Within the scope of these applications, income tax withholding support and Social

Security Premium Support (Employee’s Share) are not applied.

• Effective from January 1, 2021, supplement to the Decision for the districts that will

benefit from sub-regional supports, ANNEX-7:

Ankara

Çamlıdere

Bala

Haymana

Adana

Yumurtalık

İmamoğlu

Karataş

Karaisalı

Tufanbeyli

Aladağ

Feke

Saimbeyli

Afyonkarahisar

Kızılören

İhsaniye

Bayat

Sinanpaşa

Hocalar

Çobanlar

Aksaray

Ortaköy

Sarıyahşi

Eskil

Ağaçören

Güzelyurt

Gülağaç

Amasya

Göynücek

Hamamözü

Antalya

Gündoğmuş

Aydın

Kuyucak

Germencik

Karacasu

Sultanhisar

Köşk

Buharkent

Yenipazar

İncirliova

Bozdoğan

Koçarlı

Karpuzlu

Balıkesir

Savaştepe

Dursunbey

Sındırgı

Havran

Kepsut

İvrindi

Balya

Bartın

Kurucaşile

Bilecik

Gölpazarı

İnhisar

Yenipazar

Bolu

Yeniçağa

Mudurnu

Göynük

Seben

Kıbrısçık

Dörtdivan

Burdur

Kemer

Ağlasun

Cavdır

Çeltikçi

Yeşilova

Altınyayla

Bursa

Harmancık

Keles

Büyükorhan

Çanakkale

Bayramiç

Yenice

Çankırı

Bayramören

Çorum

Ortaköy

Boğazkale

Uğurludağ

Mecitözü

Bayat

Laçin

Denizli

Babadağ

Kale

Beyağaç

Baklan

Güney

Çameli

Düzce

Çilimli

Kaynaşlı

Cumayeri

Gölyaka

Yığılca

Edirne

Enez

İpsala

Meriç

Lalapaşa

Elazığ

Kovancılar

Karakocan

Alacakaya

Maden

Palu

Baskil

Sivrice

Arıcak

Erzincan

Otlukbeli

Tercan

Çayırlı

Erzurum

Horasan

Hınıs

Şenkaya

Çat

Köprüköy

Tekman

Karaçoban

Karayazı

Eskişehir

Alpu

Günyüzü

Han

Gaziantep

Nizip

İslahiye

Oğuzeli

Nurdağı

Karkamış

Araban

Yavuzeli

Hatay

Arsuz

Reyhanlı

Yayladağı

Hassa

Kumlu

Altınözü

Isparta

Şarkikaraağaç

Aksu

Gelendost

Sütçüler

İzmir

Bayındır

Beydağ

Kiraz

Karabük

Eskipazar

Yenice

Ovacık

Eflani

Karaman

Kazımkarabekir

Başyayla

Sarıveliler

Ayrancı

Kastamonu

Daday

Cide

İhsangazi

Hanönü

Azdavay

Pınarbaşı

Şenpazar

Doğanyurt

Kayseri

İncesu

Felahiye

Yahyalı

Bunyan

Yeşilhisar

Pınarbaşı

Sarıoğlan

Tomarza

Sarız

Akkışla

Kırıkkale

Karakeçili

Delice

Keskin

Sulakyurt

Balışeyh

Celebi

Kırklareli

Demirköy

Pehlivanköy

Kofçaz

Kırşehir

Akpınar

Çiçekdağı

Boztepe

Akçakent

Kilis

Musabeyli

Polateli

Konya

Kulu

Sarayönü

Hadim

Taşkent

Güneysınır

Hüyük

Kadınhanı

Doğanhisar

Tuzlukçu

Yalıhüyük

Bozkır

Derebucak

Altınekin

Çeltik

Yunak

Derbent

Halkapınar

Emirgazi

Ahırlı

Kütahya

Domaniç

Hisarcık

Şaphane

Pazarlar

Dumlupınar

Altıntaş

Çavdarhisar

Aslanapa

Malatya

Hekimhan

Doğanşehir

Akçadağ

Yazıhan

Doğanyol

Arguvan

Kuluncak

Kale

Pütürge

Manisa

Saruhanlı

Köprübaşı

Ahmetli

Gölmarmara

Selendi

Mersin

Aydıncık

Mut

Gülnar

Muğla

Seydikemer

Nevşehir

Derinkuyu

Acıgöl

Niğde

Altunhisar

Çiftlik

Osmaniye

Sumbas

Rize

Hemşin

Güneysu

İyidere

Derepazarı

İkizdere

Kalkandere

Çamlıhemşin

Sakarya

Kaynarca

Ferizli

Karapürçek

Taraklı

Samsun

Kavak

Havza

Alacam

Yakakent

Vezirköprü

Salıpazarı

Asarcık

Ayvacık

Sinop

Dikmen

Sivas

Akıncılar

Zara

Gölova

Kangal

Ulaş

Altınyayla

Hafik

Yıldızeli

Koyulhisar

Trabzon

Çarşıbaşı

Araklı

Şalpazarı

Dernekpazarı

Tonya

Köprübaşı

Hayrat

Düzköy

Uşak

Banaz

Karahallı

Sivaslı

Yozgat

Aydıncık

Zonguldak

Kilimli

Gökçebe

- Yatırım Teşvik Belgesi

- Yatırım Teşvik Belgesi Müracaat İçin Gerekli Evraklar

- Yatırım Teşvik Belgesi Nasıl Alınır?

- E-TUYS

- Yatırım Teşvik Belgesi Kapsamında Yer Alan Harcamalar

- Genel Yatırım Teşvik Belgesi

- Stratejik Yatırım Teşvik Belgesi

- Öncelikli Yatırımlar

- Bölgesel Yatırım Teşvik Uygulamaları

- THE FRAMEWORK OF INVESTMENT INCENTIVES PROGRAM IN TURKEY

- Yatırım Teşvik Kredisi